Report: Unlocking the Full Power of Location Intelligence

Read more

Industry insights

Meet the Kalibrate team: Jordan Roberts, Director of Data Partnerships

Meet Jordan Roberts, our Director of Data Partnerships. In this short video, she describes her role and the reasons...

Petroleum pricing in Canada — the Q1 2024 report

Retail gasoline prices climbed in the first quarter, reaching a six month high in March, while diesel prices fell...

Kalibrate is attending ICSC Las Vegas

We're headed out to Las Vegas for the big ICSC show in May. Are you attending? Drop by and see Kalibrate at booth #5512P

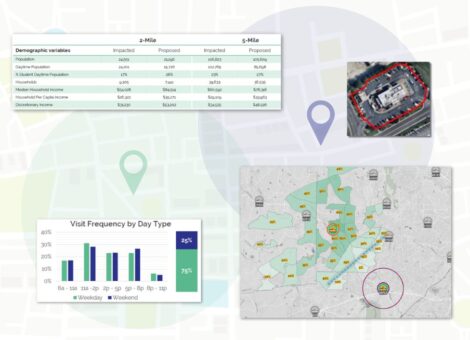

Supporting our client's sales forecasting and site evaluation methodologies

The existing process was inconsistent, labor intensive, and oftentimes redundant without a clear, consistent...

A slice of the pie: Sales transfer in franchised restaurants

How can you quantify the impact a new opening nearby will have on your location? We explore a typical approach.

Customer transfer analysis report

Through geofences, Mass Mobile Data, and our transfer analysis, Kalibrate quantifies the impact new deployments will...

March 2024. Kalibrate's Canadian Petroleum Price Snapshot

We conduct a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....

Where to invest, and where to divest for fuel retailers in North Africa

Fuel retailers across North Africa are improving their overall network quality. In this blog we discuss how fuel...

The Kalibrate fuel round up: March 2024

In this monthly feature, we look across the industry and mainstream news to uncover some stories of note that we...